Dfcu Bank and MANTRAC Uganda Join Forces to Boost Access to Heavy Machinery for Ugandan Businesses

1.

Dfcu Bank and MANTRAC Uganda Join Forces to Boost Access to Heavy Machinery for Ugandan Businesses

Kampala, Uganda, 23rd October 2025: dfcu Bank has announced a strategic partnership with MANTRAC Uganda, the authorized dealer of Caterpillar equipment, to provide businesses with affordable, flexible, and comprehensive financing solutions for brand-new machinery and power systems.

This collaboration is set to empower Ugandan enterprises, especially those dealing in construction, agriculture, logistics, mining, and manufacturing, to acquire world-class equipment and grow their operational capacity.

The partnership offers dfcu Bank customers access to MANTRAC’s wide range of high-quality Caterpillar machinery, including wheel loaders, excavators, motor graders, tractors, dump articulated trucks, mining equipment, warehousing machinery, and power generation systems. These assets are essential for industries driving Uganda’s economic development and infrastructure expansion.

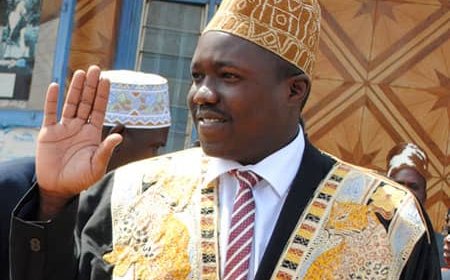

Speaking about the partnership, Kate K. Kiiza, dfcu Executive Director, Chief of Corporate and Institutional Banking at dfcu, noted that this partnership aligns with the Bank’s purpose to ‘’Transforming lives and businesses in Uganda’’ by empowering businesses through innovative financing solutions.

She said, “Our Vehicle and Asset Financing solution has always been about enabling growth. At dfcu Bank, we are committed to powering Uganda’s growth by supporting the sectors that keep our economy moving, ranging from construction and agriculture to logistics and manufacturing. Through this partnership with MANTRAC Uganda, we are bridging the financing gap that has long limited businesses from acquiring world-class machinery.

Our goal is to empower customers to scale operations with modern, efficient, and durable equipment while enjoying affordable and flexible financing options’’.

Under this partnership, dfcu Bank will provide up to 90% financing for the purchase of new machinery, requiring only a 10% down payment from the customers.

Additionally, customers can enjoy repayment periods of up to 60 months, with competitive interest rates, and a fast loan approval process within 0 to 30 days.

These terms have been designed to meet the needs of both large corporates and small and medium enterprises (SMEs) across different sectors.

The partnership caters to companies, sole proprietors, and organizations involved in industries such as construction, manufacturing, agriculture, mining, logistics, and power generation enabling them to scale operations efficiently without the heavy upfront cost of asset acquisition.

In addition to the financing benefits, customers purchasing equipment through this arrangement will enjoy Mantrac’s extended warranty of 24 months or 4,000 hours, after-sales service, operator training, and tracking devices for asset monitoring, ensuring long-term reliability, safety, and value for money.

This partnership is part of the bank’s Vehicle and Asset Financing (VAF) product where the bank deals with various car importers in Uganda.

Customers will have access to Mantrac’s full range of Caterpillar equipment including:

• Construction machinery such as wheel loaders, excavators, motor graders, articulated dump trucks, and tractors.

• Mining equipment designed for durability and productivity in tough environments.

• Power systems such as Generators and backup power solutions that guarantee reliability for commercial, industrial, and institutional use.

• Warehousing and material handling equipment, enhancing efficiency in logistics and storage operations.

What's Your Reaction?