Zombo Leaders Unveil Plan To Rescue Teachers From Extortion By Money Lenders

By Mike Rwothomio

Zombo District leaders have embarked on a plan of establishing locally owned robust SAACO for teachers to fend off excessive interest rates levied on them by financial money lenders.

The leaders argue that the financial money lenders, commonly known as ( Now Now), have stringent terms and conditions, propelling teachers to underperform or flee due to too much pressure and stress.

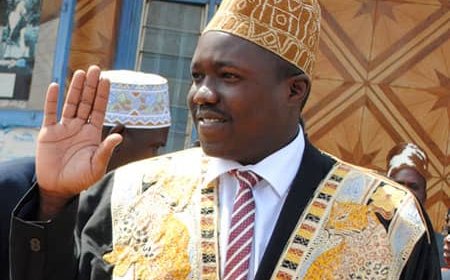

Songa Biyika Lawrence, the Mp for Ora County, in an interview with this Publication highlighted the benefits of locally owned Savings and Credit Cooperative Organizations ( SACCOs), assuring of his maximum support.

Over the years, Uganda has witnessed remarkable growth in Savings and Credit Cooperative Organizations (SACCOs), commercial banks and financial money lenders which are acting as vital financial service providers for individuals and communities.

In Zombo, over 20 financial money lenders are spread throughout the community, offering loans to the community without so much red tape.

However, the financial money lenders, according to locals, impose high interest rates with stringent terms and conditions, causing people including teachers to abandon their homes.

According to Songa Biyika Lawrence, the Ora County MP , the issue can directly be addressed when teachers have their own SACCO.

" We want teachers to have their own SACCOs, we don't want them to go and get loans from commercial banks and financial money lenders that in the long run make them to run away , we want to build a very strong SACCO from where they can borrow money at low interest rate" Songa explained.

He added that, " I'm ready to contribute and I have already made a pledge, very soon , I will meet them"

Government intervention through the regulation of interest rates charged by money lenders aims to address consumer protection concerns and inflationary tendencies, as many licensed and unlicensed lenders impose exorbitant interest rates ranging from 10% to 30% per month.

The high rates are often driven by factors such as a lack of financial literacy, desperate borrowing, and insufficient transparency. As a result, individuals have lost their property to money lenders and other lenders.

Esther Afoyochan, the woman MP of Zombo confirmed her support of 10 million shillings to Zombo teacher's SACCO, to help them instead of rushing to financial money lenders. It's not clear whether the group has received the money.

Speaking during a recent function organized by Catholic Women Association of Paidha Catholic Parish at Oturgang Mission, Afoyochan expressed Concerns over rampant confiscation of national identity cards by financial money lenders to act as collateral for loans.

The practice of National Identity cards confiscation by money lenders continues unabated in Zombo , notwithstanding existing laws, including Article 29(2)(c) of the Constitution and the Registration of Persons Act, that prohibit the unauthorised possession or confiscation of National ID.

Sunday Omirambe, an area resident of Jangokoro Sub-County, also an aspirant for Okoro County MP seat reasons that, " many people find it easy to access funds from money lenders because they don't have so many bureaucracy like other loans from banks"

Omirambe called upon leaders to " form Alur SACCO to save locals from excessive interest rates from money lenders "

Last year, the Minister of Finance, Planning and Economic Development issued a statement, containing capping the maximum interest money lenders can charge at 2.8% per month or 33.6% per annum. This is in line with the Legal Tier 4 Microfinance Institutions and Money Lenders Act, Cap. 61 - Prescription of Maximum Interest Rate.

Local residents react

Jerose Mandhawun, a resident of zingili cell said, " we are going to money lenders because they don't delay giving us money,though their interest rate is high"

Jane piyic, a vendor from Paidha main Market said, " I registered for Pdm 2 -years ago and up to now, I haven't receive anything, I rather go for money lenders that don't delay giving us money"

A money lender is defined under the Act as a company that has been issued a money lending licence and for one to be licensed, they must apply and be issued a licence to carry on money lending business.

The Zombo District inspector of schools Silvio Jalar, acknowledged the challenges teachers face as a result of accumulated loans, in a recent interview.

" Many of our staff sometimes pass on due to factors which are stress related , you find the salary somebody earn is very meager against the cost-of-living today" Jalar said.

Though designed with positive intentions for the economy, the high interest rate can have unintended negative impact, particularly for low-income earners.

It's against that backdrop that President Yoweri Museveni last year, declared war on money lenders, stating “We will crush their operations”

Under the Tier 4 Microfinance Institutions and Money Lenders Act, Cap. 61 (“the Act”), the Minister for Finance has the power to control interest rates and may, through consultation with the Uganda Microfinance Regulatory Authority, prescribe a maximum interest rate that a money lender shall charge.

What's Your Reaction?